IBEC financing is provided in accordance with the "Basic Terms and Conditions of International Bank for Economic Co-operation for Trade Finance Loans to Financial Institutions" (hereinafter referred to as the "Basic Terms and Conditions"). You can join these terms by sending respective SWIFT notification to IBEC in the form and in the manner provided in this document. "Basic Terms and Conditions" are considered to be concluded, in force and applicable only upon the receipt of the relevant notification from IBEC.

Each individual loan is to be negotiated separately after the accession of the partner bank to the "Basic Terms and Conditions".

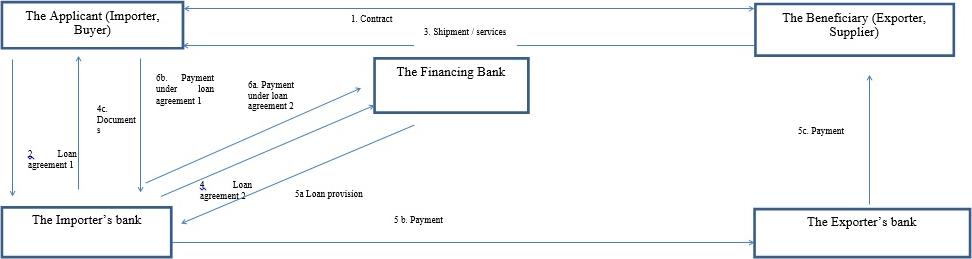

1 A loan can be provided after the Importer’s Bank has paid the Exporter’s Bank (refinancing)

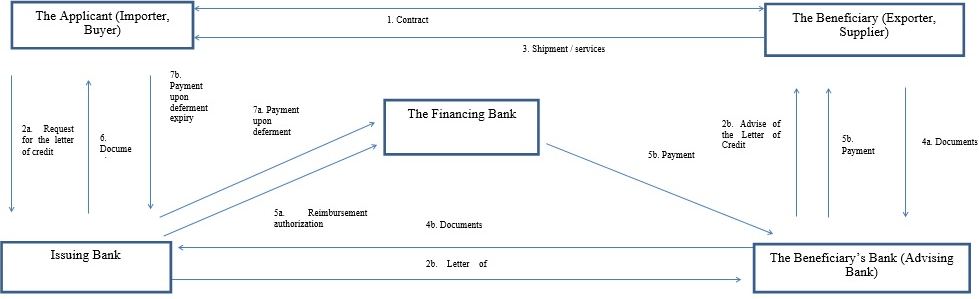

2 The letter of credit form can be used for settlements

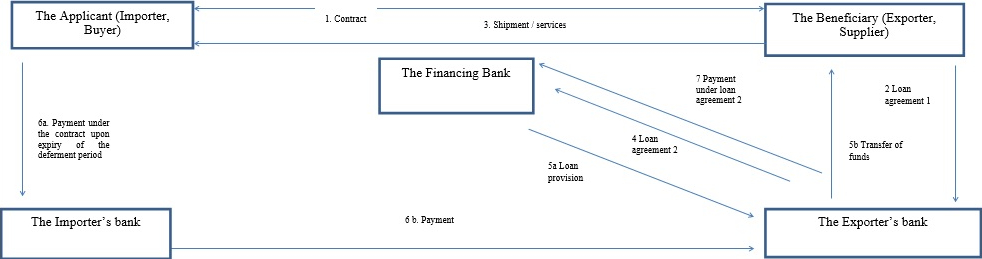

1 A loan can be provided after the Exporter’s Bank has paid the Exporter (refinancing)

2 The letter of credit form can be used for settlements

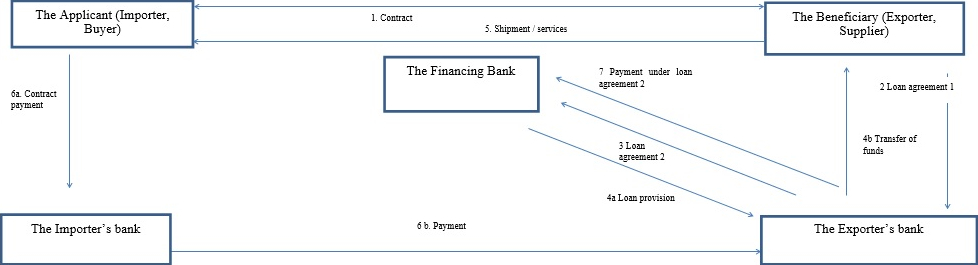

1 A loan can be provided after the Exporter’s Bank has paid the Exporter (refinancing)

2 The letter of credit form can be used for settlements